It is the worst-case scenario for any organization – losing your status as a 501(c)(3) public charity. In this article, we discuss the four most common ways nonprofits lose their tax-exempt status from the IRS, and the steps you can take to avoid them.

Staying Legal: The Strings Attached to Your Tax-Exempt Status

It is the worst-case scenario for any organization – losing your status as a 501(c)(3) public charity. In this article, we discuss the four most common ways nonprofits lose their tax-exempt status from the IRS. Those include:

- Failing to file the IRS Form 990 for 3 years;

- Engaging in political activity;

- Exceeding the limits on lobbying; and

- Providing benefits to insiders.

Your organization had to jump through a lot of hoops to receive its tax-exempt status from the Internal Revenue Service. It needed to first become an Ohio nonprofit, and then needed to file Form 1023 with the Internal Revenue Service. If the organization proved to the IRS that it was organized and operated exclusively for an allowed charitable purpose (among other things), it was granted 501(c)(3) tax-exempt status.

Why does a nonprofit go through all that hassle to become a 501(c)(3) public charity? The biggest reasons include avoiding federal income tax, donors being able to deduct their charitable contributions, and qualifying for grants from foundations and other funders.

It is important for board members to understand that once tax-exempt status is granted, it does not mean that your organization will remain a tax-exempt organization no matter what. Your organization must continue to meet all the requirements it said it met when it first applied to the IRS for tax-exempt status to continue to receive the preferential tax treatment. On top of that, your organization must intentionally and continuously meet the following criteria – what we consider the additional “strings” attached to your tax-exempt status.

File a Form 990 Every Year

The Internal Revenue Service Form 990 is the annual tax return public charities must file every year. It is not your typical tax return. The IRS uses Form 990 to peek under the hood of your nonprofit to see how it is governed, supported, operated, and how it uses its assets. Taken as a whole, it can paint a picture of your organization for not only the IRS to see, but for everyone to see – Form 990 is a public document, and provides for transparency and accountability with donors, grantors, and the public in general.

If your organization fails to file a Form 990 for 3 consecutive years, your tax-exempt status is automatically revoked – so it is critical that your organization does not miss this annual deadline. From a practical standpoint, we recommend that you make sure the annual deadline to file is on multiple individuals’ calendars. Update your mailing address with the IRS if needed, and, as a best practice, make sure all board members have time to review the Form 990 prior to the filing deadline.

| TIP: Calendar filing deadlines on multiple calendars. |

No Political Activities

A 501(c)(3) public charity cannot support or oppose a political candidate running for public office at any level – federal, state, or local. Any amount of political activity can result in losing your tax-exempt status.

Your organization’s board members and leaders must be aware that while they can engage in political activity in their private lives, they must keep that separate from their role with the organization. That means not using the organization’s offices, staff, or resources for a candidate, and not engaging in political activity at your events, in your newsletters, or while representing the organization in any way.

It is common for political candidates to want to align themselves with a 501(c)(3) public charity’s mission or want to utilize the organization’s space or network. To protect your tax-exempt status, you should speak with legal counsel before your organization engages in any relationship with a political candidate.

For more detailed information, see this article FAQs: Election-Related Activities and 501(c)(3) Public Charities

Lobbying Within Limits

While 501(c)(3) public charities cannot support anyone running for a political office, they can engage in lobbying, which involves contacting legislators or urging others to contact them to propose, support, or oppose legislation. However, there are reporting and disclosure requirements, and the amount of lobbying a public charity can do is limited. Excessive lobbying can lead to the loss of tax-exemption.

If your organization is lobbying legislators directly or indirectly through the public, or supporting or opposing ballot issues, contact your lawyer. It is important to discuss what records need to be kept, any necessary disclosures that need to be made, and to make sure the amount of lobbying you are doing is below the legal limits. There is also an optional election an organization can make with the IRS that effectively increases its limits on lobbying.

For more information, see this article Lobbying Restrictions and Reporting Requirements for 501(c)(3) Organizations

Avoid Excessive Benefits to Insiders

Your organization’s “insiders” – the founders, board members, anyone with influence over the organization, and their family members – cannot receive benefits from your organization that are greater than what they provide in return. In addition to financial penalties, any amount of excess benefit can lead to the loss of tax-exempt status for your organization.

For example, board members have a responsibility to make sure that an executive director’s compensation is reasonable for the work they do and not excessive. You cannot pay above-market rent for a building owned by the board president or allow a board member to lease your office space for less than what you could get paid on the open market. And you cannot hire an accountant that is related to a board member and pay them more than their normal rate or more than what other accountants charge.

This does not mean there can be no relationship between the organization and its insiders, it just means that any relationship must be reasonable. As a board member, when you see that an “insider” is entering into a transaction with your organization, you have a responsibility to ask the board to pause and evaluate the benefit received by the insider.

There is a clear process the IRS wants you to follow to prove that the organization’s relationship with the “insider” is reasonable. This process should be outlined in your conflict of interest policy. It should include disclosure of the potential conflict, the collection and review of objective comparability data from multiple sources, discussion and a vote by the disinterested board members, and documentation in your meeting minutes.

For more details on conflicts of interest, see the article in this series titled Keeping House: Three Policies Every Nonprofit Needs.

| TIP: Follow the process outlined in your nonprofit’s conflict of interest policy. |

Conclusion

Your organization worked hard to obtain its 501(c)(3) tax-exempt status – and as a board member you need to be aware of the actions (or inactions) that can cause you to lose it.

Additional Resources

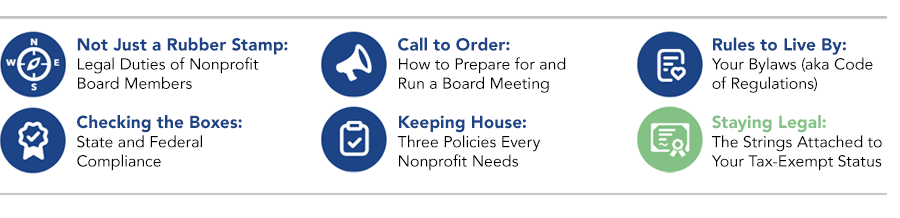

This article is part of the series I’m On a Nonprofit Board – Now What? The Legal Governance Lowdown for Nonprofit Board Members and Leaders So You Can Come to the Table Ready to Lead. Published by Pro Bono Partnership of Ohio, this series includes a 6-part webinar series and corresponding articles on important topics that will help you confidently take your seat at the board table and continue to make a positive impact in our community.

- PBPO article: Lobbying Restrictions and Reporting Requirements for 501(c)(3) Organizations

- PBPO article: FAQs: Election-Related Activities and 501(c)(3) Public Charities

- PBPO article: Keeping House: Three Policies Every Nonprofit Needs

- IRS Form 990

- IRS Form 1023

Need Legal Advice?

Pro Bono Partnership of Ohio is here to help. We regularly advise organizations on transactions with insiders, lobbying within legal limits, and avoiding political activity.

If you are a PBPO client and have questions regarding the content of this article or need legal assistance, please contact us at [email protected] or (513) 977-0304.

Not a Client? Apply to become a client by submitting a Request for Legal Assistance online or contact us at [email protected].

Disclaimer

These resources are provided as a general informational service to clients and friends of Pro Bono Partnership of Ohio. They should not be construed as, and do not constitute, legal advice on any specific matter, nor do they create an attorney-client relationship. You should seek advice based on your circumstances from an independent legal advisor.

These resources are protected by U.S. and international copyright laws. While we encourage widely sharing these materials in their entirety for educational purposes and with full credit given to Pro Bono Partnership of Ohio, the unauthorized reproduction of these copyrighted works is prohibited. Copyright © 2025 Pro Bono Partnership of Ohio. All rights reserved.